Credit Repair Myths Debunked: Dividing Fact from Fiction

Credit Repair Myths Debunked: Dividing Fact from Fiction

Blog Article

The Trick Benefits of Credit Fixing and Its Impact on Your Lending Qualification

In today's economic landscape, comprehending the intricacies of credit scores repair work is necessary for anybody looking for to boost their financing eligibility. By attending to common credit score report mistakes and enhancing one's credit report score, individuals can open a variety of benefits, including access to extra positive loan alternatives and passion prices.

Recognizing Credit Report

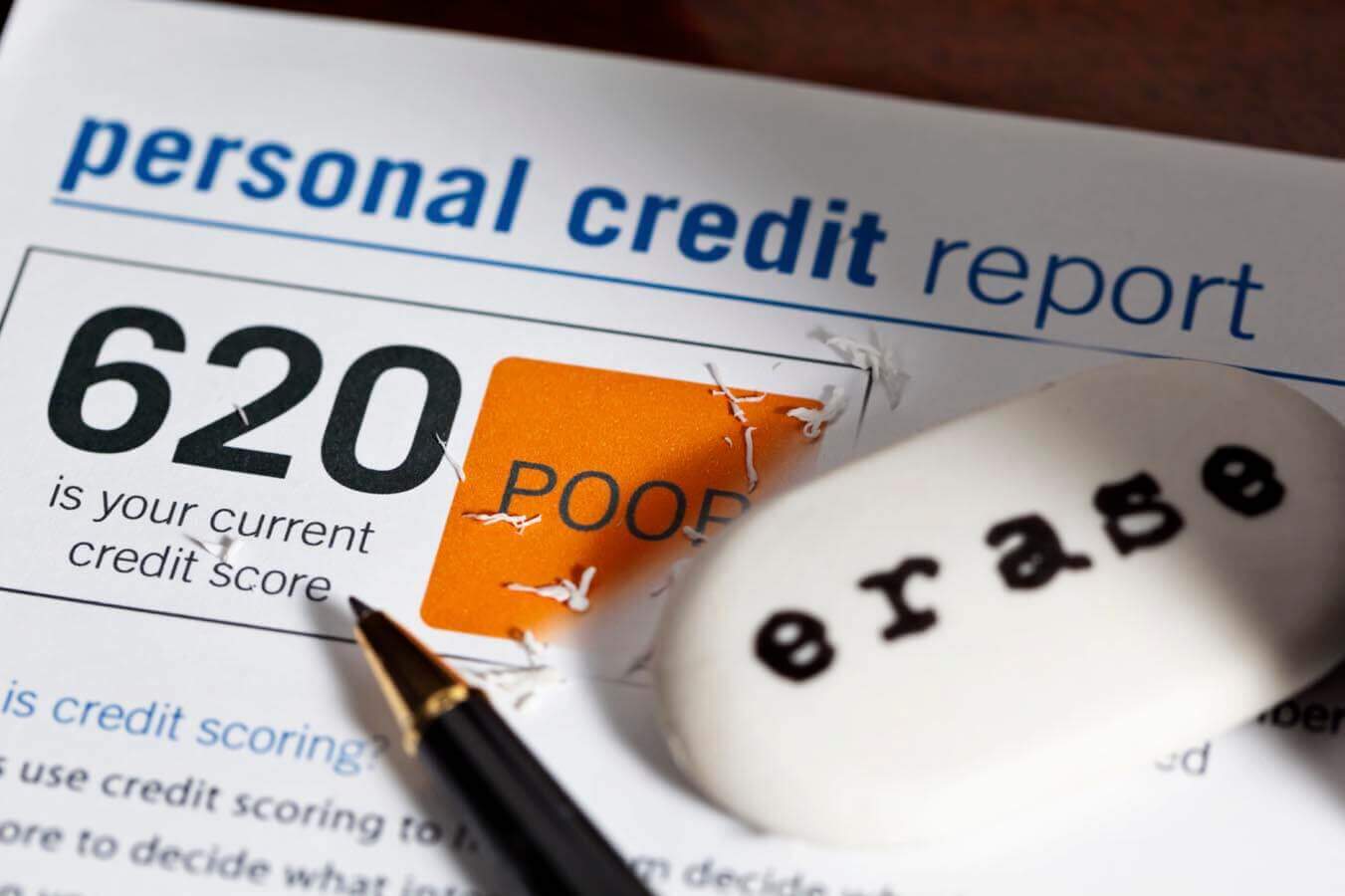

Credit report are a crucial part of individual finance, acting as a mathematical representation of a person's credit reliability. Normally varying from 300 to 850, these scores are determined based on different factors, consisting of settlement background, credit score usage, size of credit report, kinds of credit report, and current inquiries. A higher credit rating shows a reduced threat to loan providers, making it easier for individuals to secure financings, credit report cards, and favorable passion rates.

Comprehending debt ratings is necessary for reliable monetary administration. A rating over 700 is typically taken into consideration excellent, while ratings listed below 600 may impede one's ability to obtain credit report. Unsurprisingly, lending institutions make use of these scores to evaluate the possibility of payment, which directly impacts financing qualification and terms. Credit history scores can influence insurance premiums and even employment possibilities in some industries.

Frequently monitoring one's credit rating can supply insights into one's economic wellness and emphasize locations for improvement. By preserving a healthy debt rating, people can enhance their economic opportunities, safeguard far better finance conditions, and inevitably attain their financial goals. Therefore, a thorough understanding of credit score ratings is crucial for any person aiming to navigate the complexities of individual money efficiently.

Typical Debt Report Errors

Errors on debt reports can considerably influence an individual's credit history and overall monetary health. These mistakes can develop from various resources, consisting of data entrance errors, obsoleted information, or identity theft. Common kinds of mistakes include incorrect individual information, such as misspelled names or incorrect addresses, which can result in complication concerning a person's credit score background.

Another constant concern is the misreporting of account standings. A shut account may still appear as open, or a timely payment may be erroneously taped as late. Furthermore, accounts that do not come from the individual, commonly because of identity burglary, can badly distort creditworthiness.

Replicate accounts can additionally create disparities, resulting in inflated financial obligation degrees. Outdated public records, such as insolvencies or liens that must have been removed, can stick around on credit report records longer than permitted, adversely affecting credit rating scores.

Given these potential pitfalls, it is important for people to routinely assess their credit scores records for mistakes. Identifying and remedying these errors immediately can assist maintain a much healthier credit history account, inevitably influencing loan eligibility and safeguarding positive rate of interest.

Advantages of Credit Scores Repair Service

In addition, a more powerful credit scores ranking can cause enhanced accessibility to credit. This is particularly helpful for those seeking to make significant acquisitions, such as homes or cars. Additionally, having a healthy and balanced credit scores score can get rid of or decrease the need for down payment when authorizing rental agreements or setting up energy services.

Beyond immediate financial benefits, individuals that take part in credit repair work can likewise experience a renovation in their overall economic proficiency. As they discover more concerning their credit scores and monetary monitoring, they are much better geared up to make enlightened choices relocating onward. Ultimately, the advantages of credit score repair service prolong past numbers; they cultivate a feeling of empowerment and stability in individual finance.

Effect On Loan Qualification

A solid credit report profile considerably influences lending eligibility, affecting the conditions under which lending institutions agree to approve applications. Lenders utilize debt ratings and records to evaluate the danger linked with offering to an individual. A higher credit rating normally correlates with far better loan options, such as lower rate of interest and much more favorable settlement terms.

Alternatively, an inadequate credit report can result in greater rates of interest, larger deposit demands, or outright funding denial. additional info Credit Repair. This can impede an individual's capacity to protect necessary financing for substantial acquisitions, such as automobiles or homes. A suboptimal credit report profile might restrict access to different kinds of loans, consisting of individual car loans and credit cards, which can even more bolster monetary troubles.

By addressing inaccuracies, settling outstanding debts, and developing a positive payment history, people can enhance their credit rating ratings. Recognizing the effect of credit rating health and wellness on car loan qualification underscores the significance of proactive credit score administration techniques.

Actions to Beginning Credit Report Repair Service

Various individuals looking for to improve their credit ratings can profit from a structured technique to credit report repair work. The very first step entails acquiring a duplicate of your credit history report from all three significant credit score bureaus: Experian, TransUnion, and Equifax. Review these records for inaccuracies or discrepancies, as mistakes can negatively influence your score.

Next, identify any kind of arrearages and prioritize them based upon seriousness and quantity. Contact lenders to negotiate layaway plan or negotiations, which can be an important action in showing duty and dedication to fixing financial obligations.

When inaccuracies are determined, documents disagreements with the credit rating bureaus - Credit Repair. Provide documentation to sustain your claims, as this may quicken the elimination of wrong entries

Furthermore, establish a spending plan to guarantee timely settlements progressing. Regular, on-time payments will considerably enhance your credit rating gradually.

Last but not least, consider seeking specialist help from a trusted credit rating repair service business if DIY approaches confirm frustrating. While this may sustain extra prices, their experience can streamline the procedure. By complying with see here now these actions, people can successfully enhance their credit score account and pave the method for far better car loan eligibility.

Conclusion

In verdict, credit history repair offers as a vital device for enhancing credit score scores and enhancing finance qualification. By attending to usual credit rating record mistakes and promoting monetary literacy, individuals can attain far better lending choices and beneficial repayment terms.

By addressing typical credit score report mistakes and improving one's credit scores score, individuals can unlock a variety of advantages, consisting of accessibility to extra positive car loan choices and rate of interest rates. Normally ranging from 300 to 850, these ratings are determined based on numerous aspects, consisting of settlement background, credit report application, length of credit score background, kinds of credit, and recent inquiries. A have a peek at this site greater debt rating shows a reduced threat to loan providers, making it much easier for individuals to protect financings, credit rating cards, and positive rate of interest rates.

Boosted credit history ratings commonly result in a lot more positive rate of interest rates on car loans and debt items.In verdict, credit history fixing offers as an essential device for improving credit report scores and improving finance qualification.

Report this page